Airbnb Which Number to Use for Taxes 1099 K

The room is 6 of her home space. Mine still shows my.

How To Add Airbnb Income On Your Tax Return Vacationlord

If you operate multiple Airbnb accounts you may receive more than one tax form.

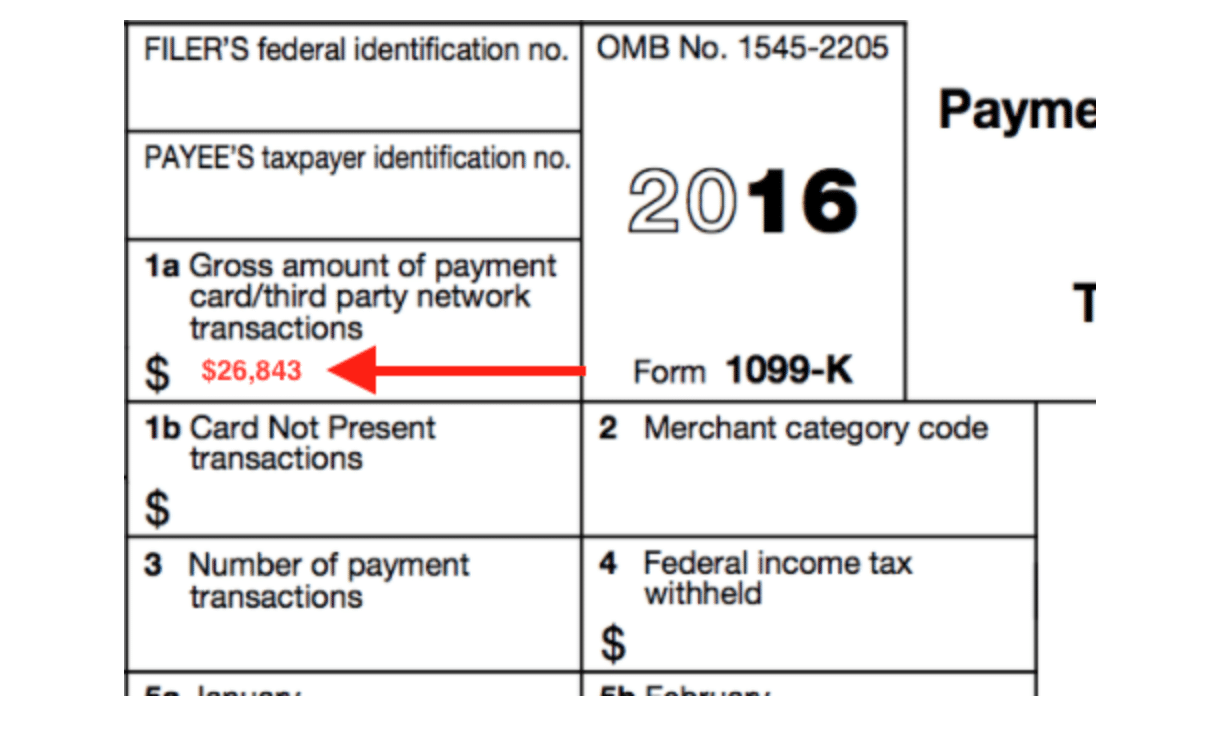

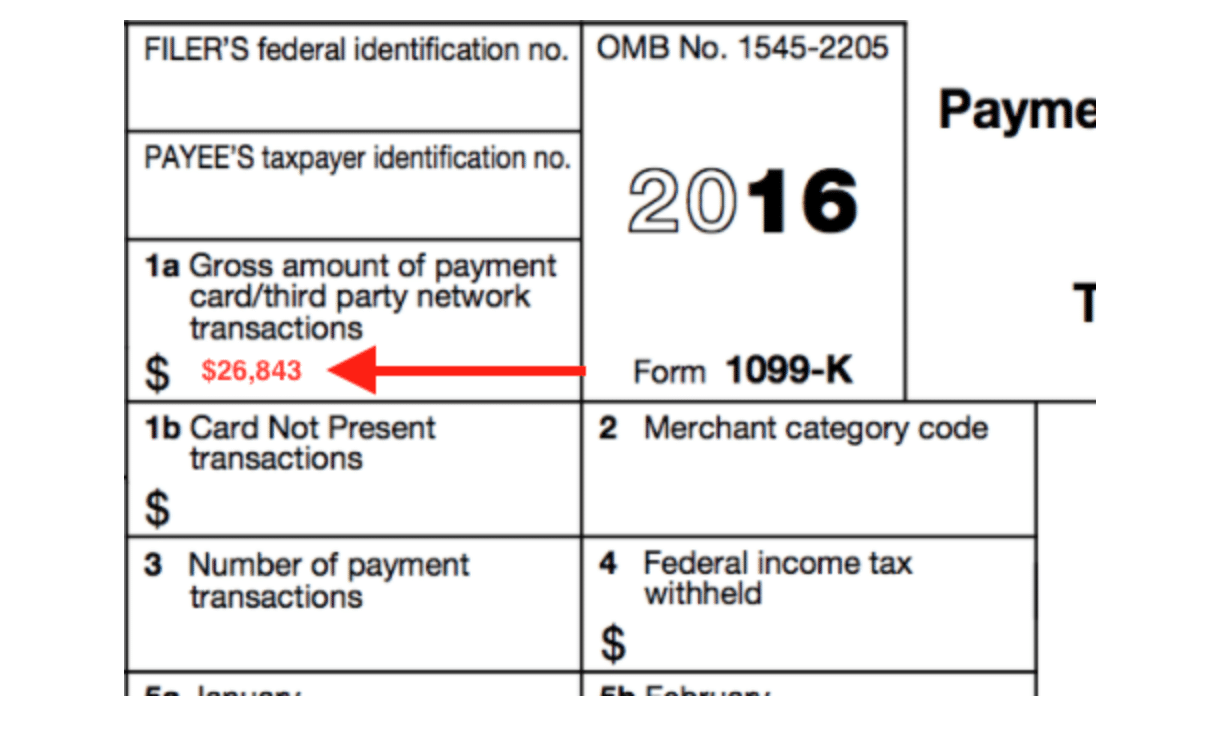

. If you have over 200 reservations and make over 20000 per year Airbnb will send you an IRS Form 1099-K. To confirm our Hosts US tax status and otherwise issue accurate information returns youll need to provide taxpayer info for yourself and any beneficiaries of payouts by completing Form W-9 W-8ECI. Airbnb is obligated to deduct 1 of the gross earnings of Hosts who are residents of India and remit these funds to the Indian tax authorit.

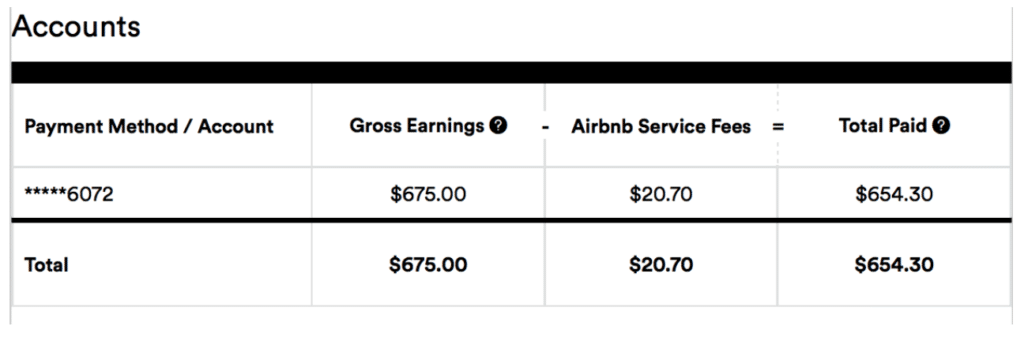

So without this form or a 1099-Misc how do you report these earnings. The calculation of rental expenses for the part of the home you rent. Here is a sample entry from Airbnb.

Federal Income Tax Withholding If you did not provide Airbnb with your appropriate tax information such as your social security number Airbnb may have withheld income taxes from your payments. Airbnb is required to report gross earnings before deducting the. The Service Fees and Adjustments also need to be reported as deductions against income which we will talk about in the next section.

Beginning January 1 2022 Airbnb will be required under the new law to withhold up to 30 tax exact tax withholding percentage will vary on certain payouts if. You must divide certain expenses between the part of the property used for rental purposes and the part of the property used for personal purposes as though you actually had two separate pieces of property. Airbnb taxes can be frustrating.

Starting January 1 2022 the IRS requires US companies to report gross earnings for all US users who earn over 600 in the calendar year. If you have less you wont receive a formal 1099-K form. But youll need to file.

Is there a phone number for Airbnb and if so where do you find it. Regardless or not if you received this form you must report income you earned on Form 1040 unelss the non-taxable rental exemption applies. As a result of ARPA Airbnb must issue Form 1099-K for all US citizen or tax resident Hosts earning over 600 effective January 1 2022.

You are allowed to recover the withholding to the extent allowed by claiming a credit. Ill make around 11k on my Airbnb listing this year. Do report the 1099-K amount on form 1040 Line 21 Other Income with the description AirBnb 1099 Do report the 1099-K amount again as a negative number on form 1040 Line 21 Other Income with title Non-Taxable AirBnb 1099 - see attached Sec280A Statement.

This will net taxable income to zero. 70 days is 19 of the total 365 days as a rental so 1200 of indirect expenses times 19 equals 228. Get the answers to all of your Airbnb tax filing questions here.

Understanding this can be tricky because Airbnb only sends you a 1099-K if your rental income was at least 20000 or you have had more than 200 reservations in a year. Airbnb issues form 1099-K if you pass 200 transactions or earn 20000 in gross revenues or Gross Earnings according to Airbnb. Airbnb is not sending out 1099-K forms to all hosts in 2016 only to those who earned over 20k.

If you exceed both IRS thresholds in a calendar year Airbnb will issue you a Form 1099-K. Airbnb will report 2022 payouts at the new Form 1099 threshold as required under the American Rescue Plan Act of 2021. Create a Danish unique code.

Will Airbnb send me a 1099-K. You will need to enter 365-the number of days you rented the room. In the Taxpayer Information section you can access your 1099-K.

The withheld amount will be reported on Form 1099-K box 4. You need to keep track of deductions and expenses. Then report any fees or commissions as.

Airbnb is required to report gross earnings before deducting our host fee and before any reservation cancellationsadjustments on Form 1099-K. Using the sample above the amount that you report on your tax return is the Gross Earnings which in this case was 15522. Ad Avalara makes it easier to apply the right tax on Airbnb bookings.

Once you receive a 1099-K youll need to report the exact amount shown in box 1a as gross receipts. Form 1099s for calendar year 2022 will be sent to Hosts in 2023. These forms are sent to the IRS as well as to you and are likely to be matched against the tax return that you submit.

Calculate state and local sales and lodging taxes even for out of state properties. The total amount of management fees in this case is. 0 Join the conversation.

If the earnings reported on Form 1099-MISC show a higher amount than you were expecting its most likely the difference between your net and gross earnings. The of transactions is going to be 85-90. If you are looking for your 2016 1099-K this likely wont be available until after the first of the year.

If you exceed the IRS threshold in a calendar year Airbnb will issue you a Form 1099-K. Sally rents a room in her home 70 days during the year. The total rental time is 19 so she can take 19 of her indirect expenses or 228 as rental expenses.

For the tax years 2021 and onwards hosts in Denmark will be required to create a unique code with the Danish tax authorities Skatdk in o. Yes Airbnb may issue you a Form 1099-K Payment Card and Third Party Network Transactions or make available an Earnings Summary reporting gross income earned during calendar year. I need a 1099K for tax.

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb Taxes What Taxes Do I Need To Collect On My Airbnb Bookings

Airbnb Liability Insurance Helps Limit Your Exposure Do You Have The Right Coverage We Have The Answers To All Of Your Air Airbnb Host Hosting Hosting Guests

Comments

Post a Comment